one Overview of global industrial development

1. Market scale

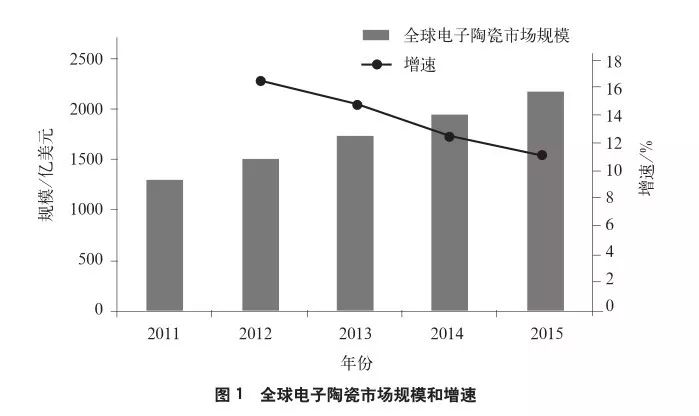

In recent years, with the rapid development of downstream applications such as communication, computer, electronic instrument and household appliances, the market scale of electronic ceramic components is growing day by day. According to the prediction of the third-party organization, the market scale of global electronic ceramics will increase from about US $130 billion in 2011 to about US $210 billion in 2015, with a compound annual growth rate of 14% (Figure 1).

2. Major producing countries

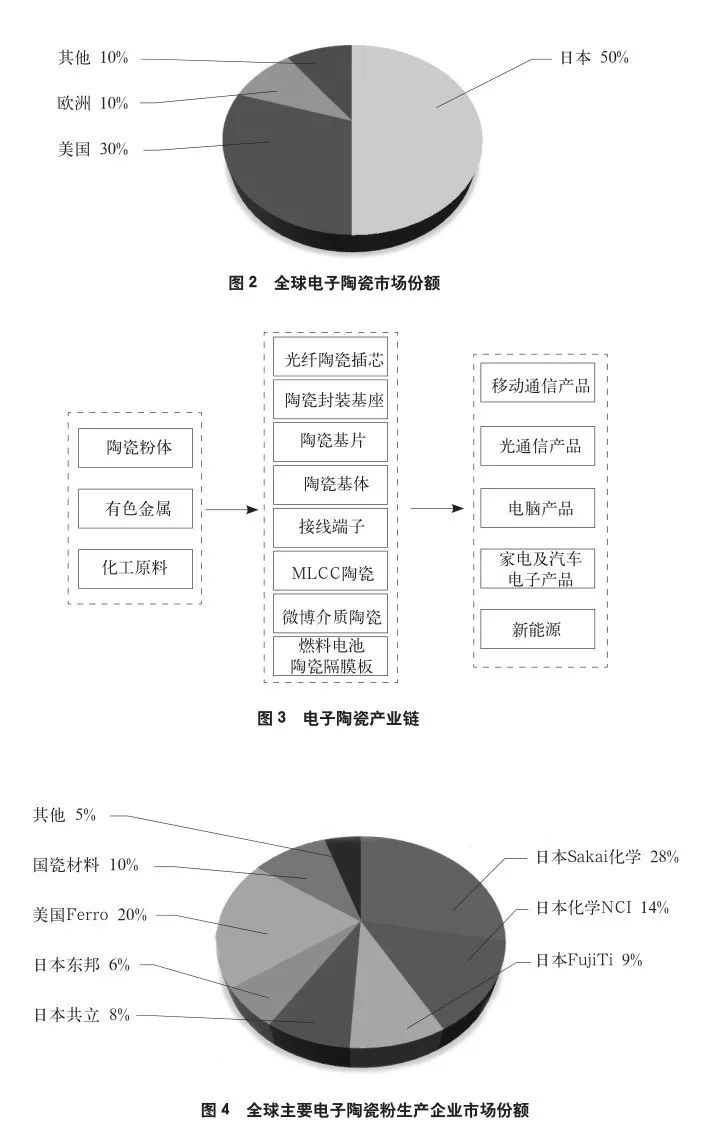

Due to high technical barriers, the electronic ceramics industry has been monopolized by Japan, the United States and some European companies with unique technologies for a long time. Among them, Japan has the largest categories of electronic ceramic materials, the largest output, the widest application fields and the best comprehensive performance, accounting for 50% of the global electronic ceramic market. In the research and development of lead-free piezoelectric ceramics, Japan has the largest number of papers and patents. The United States leads the world in the technology research and development of electronic ceramics, but the industrial application lags behind Japan, and most of the technology remains in the laboratory stage. American electronic ceramic products account for about 30% of the world market share, ranking second in the world (Figure 2). The EU mainly focuses on the development of ceramic materials to reduce the environmental load of consumption. China’s electronic ceramics industry has begun to take shape, but it is still in its infancy compared with economically developed countries such as Japan and the United States.

3. Electronic ceramic industry chain

The upstream of electronic ceramic industry includes electronic ceramic basic powder, formula powder, etc; Downstream application industries include consumer electronics, communications, automotive industry, data transmission and other electronic products, which are mainly used in oscillation, coupling, filtering and other circuits in various electronic machines. The midstream is made of electronic ceramic materials and components, mainly including optical fiber ceramic insert, ceramic packaging base, ceramic substrate, ceramic matrix, wiring terminal, chip multilayer ceramic capacitor ceramics, microwave dielectric ceramics, etc. (Fig. 3).

1. Electronic ceramic powder

Electronic ceramic powder is the main raw material for manufacturing ceramic components, and its core requirements are purity, particle size and shape. The manufacturing technology and process of high-purity, ultra-fine and high-performance ceramic powder is the bottleneck restricting the development of China’s electronic ceramic industry. This technology is basically mastered in a few developed countries such as Japan and the United States. At present, the latest preparation technology of ceramic powder in the world is ultra-high temperature technology, and Japan occupies a global leading position in ultra-high temperature technology. The urgently needed powder of electronic ceramics in China mainly depends on import.

Taking the ceramic powder material of multilayer ceramic capacitors (MLCC) as an example, its production is highly concentrated in the world. In 2013, the global output of MLCC ceramic powder was close to 50000 tons, and it is growing at a compound growth rate of 8% per year, and at a compound growth rate of 12% in China. According to China Petroleum and chemical economic analysis, more than 70% of the world’s MLCC ceramic powder materials are monopolized by Japanese enterprises. Sakai is the world’s largest manufacturer of electronic ceramic powder materials. Ferro of the United States and NCI of Japan rank second and third respectively (Fig. 4).

China’s ceramic materials are in a leading position in the production technology and market of ceramic powder, and have mastered the hydrothermal synthesis technology, nano dispersion technology and coating technology of ceramic powder. The main products include MLCC formula powder, microwave dielectric ceramic powder, nano composite zirconia, high-purity ultra-fine alumina, etc., accounting for about 10% of the global market and 80% of the domestic market. In addition, Fenghua high tech also has the production capacity of MLCC formula powder; Sanhuan group has the production capacity of additives, but it only produces and uses them for its own use and does not sell them to the outside world; Torch electronics began to develop ceramic powder formula and ultra-fine manufacturing technology. The continuous innovation of domestic enterprises has changed the situation that highly reliable MLCC and its raw materials rely heavily on imports.

2. Electronic ceramic materials and components

(1) High pressure ceramics

Rod post insulator and porcelain bushing (hollow insulator) for UHV and UHV AC / DC are key components for transmission and transformation of UHV and UHV AC / DC power grid. In 2011, the scale of the international rod porcelain industry was about 3 billion yuan, and the scale of the porcelain sleeve industry was about 4-4.5 billion yuan; The total output value of domestic rod porcelain is about 1 billion yuan and the total output value of porcelain bushing is about 1.5 billion yuan. Due to the increasing saturation of electric porcelain market in developed countries and the significant increase of production costs, many electric porcelain factories in Japan, the United States and Europe have successively changed or limited production.

At present, foreign rod porcelain manufacturers mainly include Japan Special Ceramics Co., Ltd. (NGK) and American Rapp company, and porcelain sleeve manufacturers mainly include NGK and American PPC company. Domestic rod porcelain manufacturers are relatively scattered. Tangshan electric porcelain is mainly composed of 110kV and above rod post insulators, with a domestic market share of 33.01%; Fushun high tech mainly focuses on 550kV rod products; Xi’an Electric Porcelain Research Institute, Sinoma hi tech materials Co., Ltd. (hereinafter referred to as “Sinoma hi tech”) and Sinoma hi tech focus on 110kV and other UHV products. Domestic porcelain bushing production is highly concentrated. Huaxin Electric Porcelain Appliance Co., Ltd., Fushun high tech Electric Porcelain Electrical Manufacturing Co., Ltd. (hereinafter referred to as “Fushun high tech”), Xi’an Xidian high voltage electric porcelain Co., Ltd. (hereinafter referred to as “Xi’an Electric Porcelain”) and Fushun Electric Porcelain Manufacturing Co., Ltd. account for nearly 70% of the domestic market share. However, the domestic low-voltage porcelain bushing has excess capacity, and the UHV porcelain bushing cannot meet the normal demand. The inorganic bonded hollow porcelain insulator of 750kV and above mainly depends on import. Tangshan high voltage electric porcelain Co., Ltd., Fushun high tech, Xi’an electric porcelain and Sinoma high tech have developed 363kv and 550kV hollow porcelain insulators.

(2) Optical fiber ceramic core

Optical fiber ceramic core is the core component of optical fiber connector, which is widely used in communication, LAN, optical fiber to home, high-quality video transmission, optical fiber sensing, test instruments and so on. According to the statistics of China electronic components industry association, the global ceramic insert market in 2013 was about US $290 million (about RMB 1.8 billion), and it is expected that the global ceramic insert market will be about US $440 million (about RMB 2.7 billion) by 2018.

The world’s major optical fiber ceramic plug-in manufacturers include China’s Sanhuan group, Shenzhen taichenguang Communication Co., Ltd., Japan Kyocera Co., Ltd. (hereinafter referred to as “Kyocera”), Japan adamant, South Korea Dayuan and Taiwan Foxconn Technology Group. Sanhuan group occupies the absolute leading position in the optical fiber ceramic core inserting industry. In 2013, the output of ceramic core inserts in China (including foreign enterprises in China) was close to 93% of the total global output, and Sanhuan group accounted for more than 40% of the market share.

(3) Fuel cell ceramic diaphragm

Fuel cell diaphragm plate is the core component of solid oxide fuel cell. Its main function is to transfer oxygen ions between cathode and anode and effectively isolate fuel and oxidant. Bloom energy is the world’s largest producer of solid oxide fuel cells, while Sanhuan group is the core supplier of bloom energy fuel cell diaphragm plates, accounting for 70% of its purchase share of fuel cell diaphragm plates.

(4) SMD ceramic package base

SMD ceramic packaging base is mainly used for packaging quartz crystal oscillator chip and surface acoustic wave chip. According to the data of China electronic components industry association, the global market scale of ceramic packaging base in 2013 was about 950 million US dollars (about 5.7 billion yuan), which is expected to reach 6.5 billion yuan in 2017. In the production process of ceramic packaging base, the process links such as ceramic green chip punching and atmosphere protection sintering have high technical barriers. The global market has been monopolized by Japanese enterprises for a long time, and the supply of ceramic base in China has been dependent on imports for a long time.

The main manufacturers of ceramic packaging bases in the world include Kyocera, NTK and Sanhuan group. In 2013, these three enterprises accounted for 68%, 28.6% and 3.4% of the ceramic packaging base market respectively. Kyocera is the absolute leader in the ceramic packaging base market. Its global market share was once as high as 80%, and it has enjoyed a very high gross profit level for a long time with its monopoly position. Sanhuan group has mastered the process technology of ceramic packaging base, with a global market share of about 3.4% in 2013. In the future, it will accelerate the extension of general products to high-end fields such as miniaturized products.

(5) Alumina ceramic substrate

Alumina ceramic substrate is the core component of chip resistor. According to the data of China electronic components industry association, in 2013, the global ceramic substrate market scale was about 157 million US dollars (about 1.07 billion yuan), and the global ceramic substrate market sales scale is expected to maintain an increase of about 4%, reaching about 184 million US dollars (about 1.2 billion yuan) by 2017.

At present, the main suppliers of alumina ceramic substrates include Japan maruhe, NCI, Sanhuan group, Taiwan Jiuhao, etc. In 2012, these enterprises accounted for 27.2%, 23.5%, 12.5% and 11.0% of the alumina ceramic substrate market respectively. The alumina ceramic substrate business of foreign companies is basically at a loss.

(6) MLCC capacitor

MLCC is the most mainstream product in the capacitor market and the capacitor product with the highest market share in the world. According to the data of China electronic components industry association, ceramic capacitors accounted for 49% and 49.98% of the global and domestic capacitor markets in 2013. Among them, MLCC chip multilayer ceramic capacitor has the characteristics of low ESR, high temperature resistance, high voltage resistance, small volume and high cost performance. Its market scale accounts for about 93% of the whole ceramic capacitor. In 2013, the global MLCC product market scale was US $8.18 billion, and the Chinese market scale reached 35.97 billion yuan, accounting for nearly 70% of the world. China has become a major producer and consumer of ceramic capacitors in the world, and its production and sales volume ranks in the forefront of the world.

At present, the world’s major MLCC producing countries include Japan, South Korea, the United States and China. Japan’s main production enterprises include Murata, Kyocera, solar induced electricity and electrochemistry TDK. Murata is the world’s largest manufacturer of MLCC ceramic capacitors, with a market share of more than 20%. Kyocera is a leading enterprise in the field of global technical ceramics. Its products include wireless mobile phones and network equipment, semiconductor components, RF and microwave product packages, passive electronic components, crystal oscillators and connectors, and optoelectronic devices for optoelectronic communication networks. Taiyo Yuden is a world-famous manufacturer of electronic components such as ceramic capacitors and inductors, which is prominent in the field of high capacity MLCC. KEMET has certain advantages in the application field of high-end MLCC ceramic capacitors. The main manufacturer in Korea is Samsung Electronics; China’s Taiwan giant Limited by Share Ltd and Huaxin Polytron Technologies Inc also occupy a certain market share. Domestic MLCC ceramic capacitor manufacturers are mainly Fenghua high tech, Sanhuan group, Shenzhen Yuyang Technology Development Co., Ltd., torch electronics, Chengdu Hongming Electronic Science and Technology University New Material Co., Ltd., Beijing Yuanliu Hongyuan Electronic Technology Co., Ltd.

(7) Microwave dielectric ceramics

Microwave dielectric ceramic materials refer to ceramic materials used in microwave frequency (300MHz ~ 30ghz frequency band) as dielectric materials in circuits and complete one or more functions. It has excellent properties such as high dielectric constant, low dielectric loss and low temperature coefficient. It is the key material for manufacturing microwave components such as microwave dielectric resonator, filter, dielectric antenna and dielectric guided wave circuit. It can be used in mobile communication, satellite communication and military radar. It is estimated that by 2015, the global market scale of microwave dielectric materials will exceed US $1.5 billion. The output value of microwave media materials in China is expected to exceed 800.9 billion yuan in 2015.

The main manufacturers of microwave ceramic materials and devices include Murata company of Japan, EPCOS company of Germany, trans tech company of the United States, Narda microwave west company, Morgan Electroceramics and filtronic company of the United Kingdom. The application range of their products has been serialized in 300MHz ~ 40GHz, and the annual output value has reached more than 1 billion US dollars. Jiali electronics is the largest manufacturer of microwave dielectric ceramic products in China. It has independent intellectual property rights of high and low temperature microwave ceramic materials and realizes industrialization. Its products such as mass navigation antenna, special microwave dielectric ceramics and microwave communication components are in a leading position in China. In 2015, Jiali Electronics was acquired by Beidou Xingtong, which will further consolidate the upstream position of Beidou industrial chain.

three

Opportunities, challenges and future prospects of China’s development

1. Development opportunities

Made in China 2025 is a new strategic demand for innovation driven development. In order to realize the manufacturing power strategy, the State Council issued made in China 2025, which proposed to focus on the development of integrated circuits and equipment, information and communication equipment, etc. in the key areas of the new generation of information technology industry. The key roadmap (2015 Edition) also proposes to focus on developing multi-component integrated circuits, new generation of information and communication equipment, and space communication systems, etc., to meet the growing demand for mobile Internet, Internet plus, information consumption, Internet of things, aerospace and other businesses. One of the key strategic materials that is developing is electronic ceramics. The 13th five year plan for the development of new materials industry, as a supporting plan of made in China 2025, proposes to accelerate the industrial application of electronic ceramic materials.

The urgent need of the development of China’s national defense industry. Taking MLCC as an example, MLCC is commonly used in military equipment fields such as aerospace, ships, weapons, electronic countermeasures, military signal monitoring, pocket military computers, military mobile communication equipment and so on. With the acceleration of China’s equipment modernization process, the market scale of domestic military MLCC reached 1.44 billion yuan in 2013, and maintained a growth rate of about 14%. However, its import accounted for 60% ~ 70%. With the acceleration of China’s military reform and the rapid development of national defense, it is urgent to realize the localization of military electronic ceramic components.

2. Challenges

In recent years, with the support and promotion of relevant national departments, the R & D and industrialization of electronic ceramic materials in China have achieved rapid development. The industrialization has been promoted in an orderly manner in the fields of ceramic resistance / capacitance / inductance, ceramic packaging base and ceramic core insertion, and import substitution has been gradually realized. High quality enterprises such as overseas ceramic materials, Sanhuan group and Fenghua high tech have also emerged in all links of the industry chain. But generally speaking, compared with foreign advanced electronic ceramics, the added value of most products produced in China is relatively low, and many ceramic components with high technical content in electronic machines still need to be imported in large quantities; The problems of high purification of raw materials, high density of components, large size, specific surface, complex shape and ceramic targets need to be solved urgently; The performance indexes of some domestic materials have not yet reached the indexes of similar foreign materials, the accuracy of equipment is poor, and high-end equipment depends on import; The combination of industry, University, research and application is not close, the laboratory results are lack of attention, and are seriously divorced from the practical application. Therefore, China should strive to break through the constraints of advanced core engineering process technology of electronic ceramic materials, improve the innovation level of common process technology in electronic ceramic industry, and promote the two-way transfer of new electronic ceramic technology in military and civilian fields.

3. Future outlook

Overall, the application field of electronic ceramics continues to expand. Driven by the continuous growth of downstream demand, the industrial scale will continue to expand. From the perspective of each sub field:

① High voltage electric porcelain: with the rapid development of domestic power grid construction, it has brought opportunities for supporting materials for ultra-high and extra high voltage power transmission and transformation. The demand for high voltage electric porcelain will continue to increase. It is expected that by 2020, the demand for pillar porcelain insulators of 330kV and above will reach 45000, and the demand for hollow porcelain insulators of 330kV and above will reach 13000.

② Ceramic core insertion: with the rapid development of the communication industry, the construction of wireless network optimization, transmission network expansion, 4G base station construction and other projects has been accelerated, and the scale of optical fiber ceramic core insertion industry has been further expanded.

③ Ceramic diaphragm: as the preferred clean energy system in the 21st century, the development of fuel cell has been strongly supported by countries all over the world. Although the current market demand for fuel cells is limited, the development prospect is promising, which will greatly drive the rapid development of ceramic diaphragm.

④ Ceramic packaging base: with the emergence of emerging markets such as smart phones, tablet computers, wireless network terminal equipment, GPS and Beidou navigation, the application field of quartz crystal devices continues to expand. As a supporting product of quartz crystal devices, ceramic packaging base will usher in new growth opportunities.

⑤ Ceramic substrate: chip resistors are mainly used in computer, communication, home appliances, mobile phones, digital consumer goods, automotive electronics, lighting and other fields. With the rapid growth of these fields, the demand for chip resistors is increasing. Ceramic substrate is the core component of chip resistors, and its industrial scale will continue to grow.

⑥ Ceramic capacitors: ceramic capacitors are the most widely used and used category among capacitors. With the continuous progress of technology and performance, their downstream application fields are also expanding. It is expected that the market scale of ceramic capacitors in China is expected to exceed 60 billion yuan in 2020, of which MLCC is expected to reach 55 billion yuan. China’s ceramic capacitors will develop in the direction of ultra small size, high capacity, high frequency, low cost and green environmental protection.

⑦ Microwave dielectric ceramics: it can meet the requirements of miniaturization, integration, high reliability and low cost of microwave circuits. With the development of mobile communication and modern electronic equipment, microwave dielectric ceramics have attracted more and more attention and broad development prospects in the future.